- Dollar Debrief

- Posts

- Monthly Market Debrief

Monthly Market Debrief

October 2025

Market Rollup

Indexes + 1 Company | October 2025 | Year to Date (YTD) |

S&P 500 | 2.27% | 15.87% |

DOW Jones | 2.51% | 11.49% |

NASDAQ | 4.70% | 22.27% |

CMG (Chipotle) | -19.18% | -47.87% |

CPI - 12 Month Change - September 2025 | 3% (Up 0.1% From Last Month) |

Unemployment | Report Delayed… |

October was another wild ride with the market collectively shrugging at the closed government. The S&P 500 climbed 2.3% for the month, marking its sixth consecutive monthly gain, while the Dow Jones Industrial Average gained 2.5% and the Nasdaq posted solid gains driven by continued AI enthusiasm.

However, issues are brewing… the number of declining S&P 500 stocks actually outnumbered advancing ones during October, with 296 out of 500 stocks falling. The market's strength was almost entirely concentrated in a handful of mega-cap tech stocks, with AI and the "Magnificent 7" companies accounting for the bulk of the gains. This narrow leadership has analysts at Bank of America warning that 60% of their bear market indicators are flashing red.

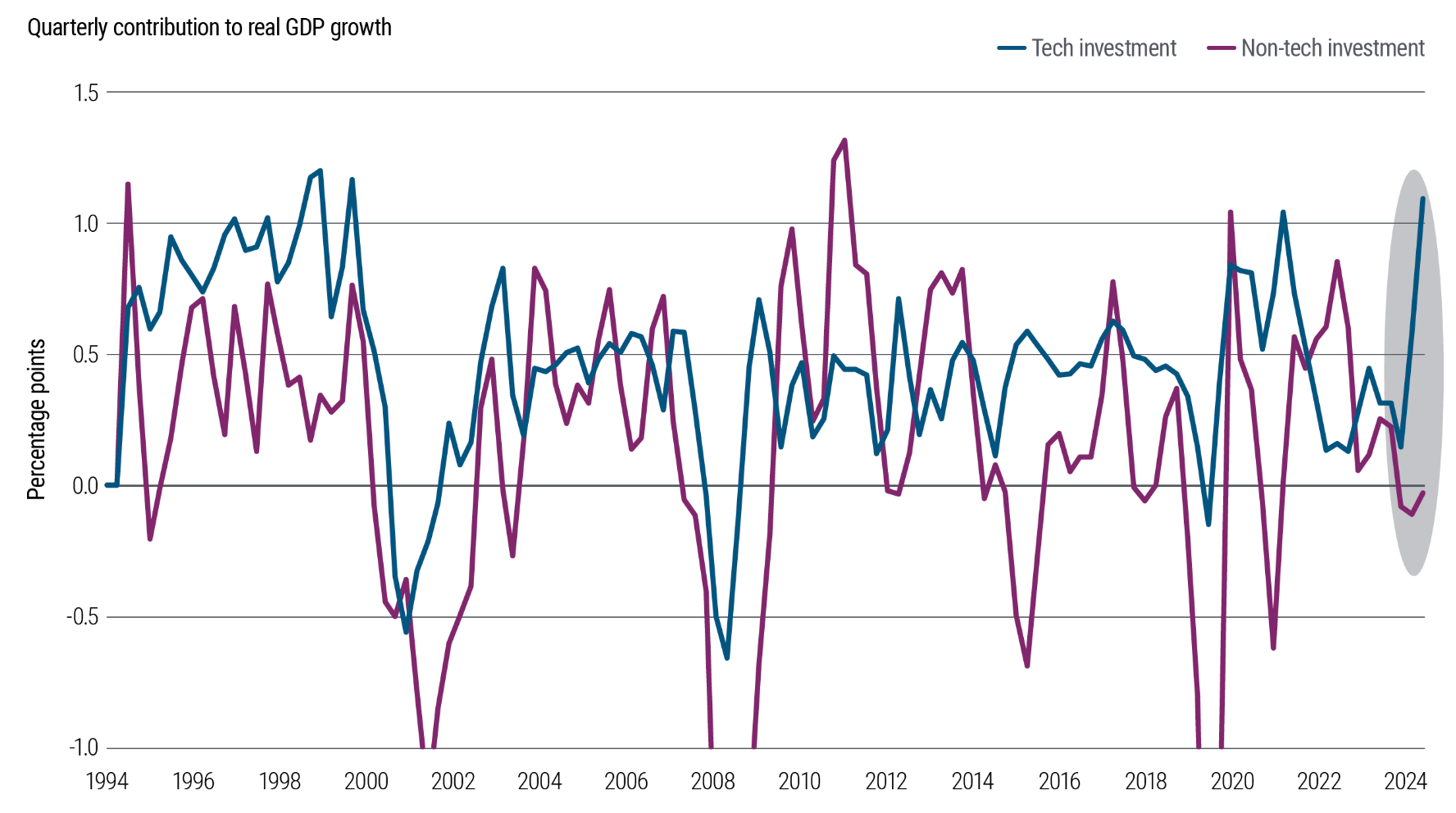

Artificial intelligence optimism and a perceived thawing of U.S.-China trade tensions after Trump and Xi Jinping met in South Korea continued this bull market run. Just how much is AI optimism lifting the economy?

If you remove all tech investment, real GDP growth for the last quarter would be negative… I am not saying there is a bubble… but I am saying we are putting a lot of faith in these robots.

The Fed Cuts Rates... Then Pumps the Brakes

On October 29th, the Federal Reserve cut interest rates by a quarter point to a range of 3.75%-4.00%, marking the second cut of 2025. Let’s keep the ball rolling, yeah?

Not so fast.

Jerome Powell immediately threw cold water on expectations for future cuts. "A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it," Powell said during his press conference, adding that there was a “growing chorus” of officials wanting to wait before cutting again. Traders lowered odds for a December cut to 67% from 90% a day earlier.

The market's reaction was swift. Stocks, which had been higher after the initial cut, turned lower on the chair's comments, with Treasury yields and the dollar jumping.

Powell's message was clear: risks to employment are increasing, inflation remains elevated, and the Fed isn't on autopilot. Don't bet on easy money.

Company Highlight (Lowlight) - Chipotle Mexican Grill

What is powering all these AI engineers if not for the slop bowls of yesterday?? Chipotle shares plunged 18% in a single day after the company cut its full-year same-store sales forecast for the third consecutive quarter.

Chipotle now expects same-store sales to decline for the year, which is a massive downgrade from February's projection of low growth.

While Q3 same-store sales technically grew 0.3%, that tiny gain came entirely from a 1.1% price increase. Customer traffic actually fell 0.8%, marking the third straight quarter of traffic declines.

Wall Street wasn't having it. At least five analysts slashed their price targets, with BTIG analyst Pete Saleh saying, "We're admittedly perplexed by how suddenly this traffic weakness came about, and not convinced affordability concerns are the main driver here".

The carnage spread to Chipotle's slop-bowl peers, with Sweetgreen falling 6% and Cava dropping 8% in sympathy.

CEO Scott Boatwright blamed "persistent macroeconomic pressures" and specifically called out the company's core demographic of 25-35 year olds struggling with unemployment, increased student loan repayments, and slower real wage growth.

Their attempts to boost traffic with new menu items like carne asada, honey chicken, and red chimichurri couldn't move the needle. That’s because these menu items are weak, and I could have told them that. When I saw those “new” items, my first thought was “Chipotle doesn’t already offer that?” Those items seem standard. That won’t get me out of bed.

Now, before I fix Chipotle’s same store sale issues, I must remind you that I came up with the Starbucks protein packed coffee idea first. So, for legal reasons, I must trademark these ideas by declaring them officially trademarked.

Chipotle must start selling two things:

Creatine Infused Rice™ - The protein packed item craze is peaking. The creatine wave is just starting.

THe Churro™ - The TH and C are capitalized because this will be a THC infused churro.

Appeal to the gym rats and pot heads. Chipotle must meet their customers where they are. You’re welcome.

Debrief on Deck

Next Week, we talk about stable coins, which are fancy ways to bring stable cryptocurrencies to people looking out of the traditional finance systems by using… the traditional finance system. You can never escape the dollar.

Wilson