- Dollar Debrief

- Posts

- The 10-Year Treasury Bond

The 10-Year Treasury Bond

The REAL driver of mortgages

Not only do I have to register my vehicle every year, but I also have to get an inspection?? If I want to drive an unsafe vehicle while ignoring the safety of others on the road, that’s my god given right! This is tyranny!

The 10-Year Treasury Bond

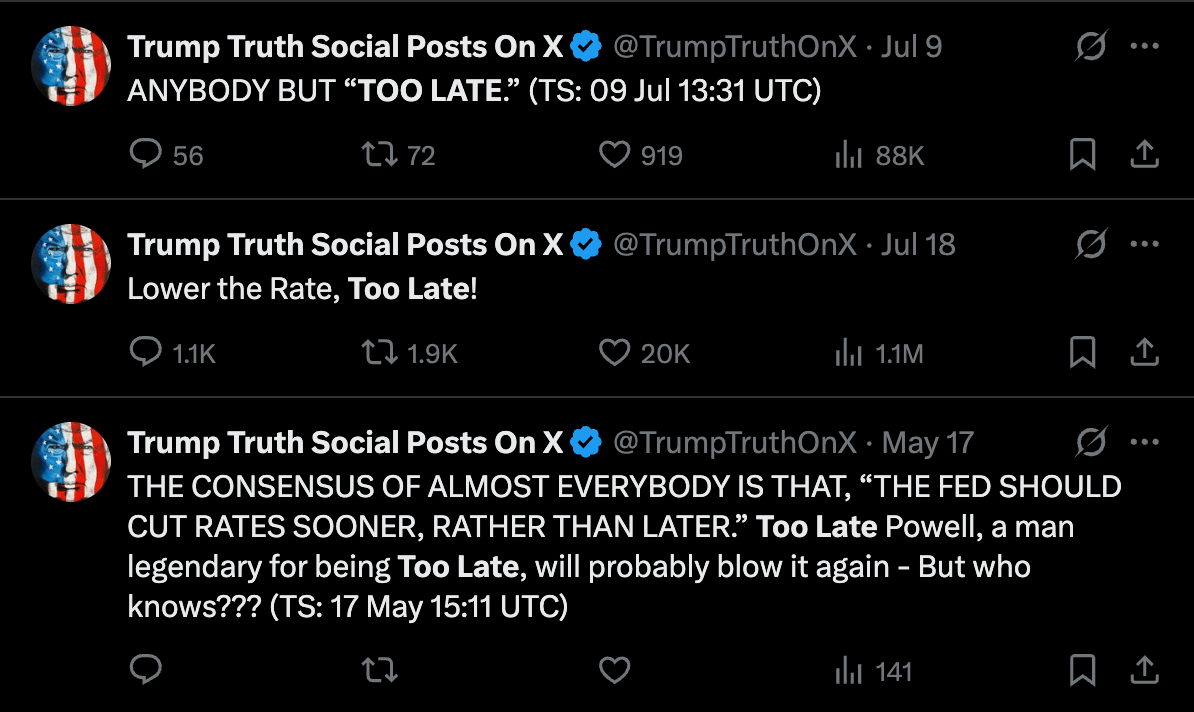

The Federal Reserve continues to hold its benchmark rate at 4.25 to 4.50 percent as we wait to see how the new tariffs affect prices. This has frustrated Donald Trump, who recently began calling Jerome Powell “TOO LATE.”

Who is “almost everybody”?

There’s a common misconception that the Fed’s interest rate (officially called the federal funds rate) directly determines mortgage rates. Unfortunately, that’s not how it works. Jerome Powell can’t wave a magic wand and lower mortgage rates on command.

Here’s what the federal funds rate actually does:

The funds rate is the interest rate that banks earn on reserve balances held at the Fed. That means banks can earn that rate risk-free just by holding cash, instead of lending it out. If lending to a homebuyer earns less than the funds rate, many banks simply won’t bother. This is how the Fed limits the supply of credit to help cool inflation. As a result, mortgage rates will almost never be lower than the federal funds rate.

Mortgage rates actually track more closely with the yield on the 10-year U.S. Treasury bond. That might seem odd, since mortgages are usually 30 years in length. But in reality, most homeowners either sell or refinance after 7 to 10 years. So lenders look to the 10-year Treasury as their baseline for a “risk-free” return over the average mortgage holding period.

Think of it like this: Why would a lender offer a mortgage at a lower rate than they can earn from a 10-year Treasury with no effort and virtually no risk? They wouldn’t. Similarly, why would they buy a Treasury bond at a lower yield than they could get by parking money at the Fed? Again, they wouldn’t.

So to recap: Mortgage rates are typically higher than the 10-year Treasury yield, which itself is typically higher than the federal funds rate. While the Fed does influence mortgage rates, it does so indirectly.

Let’s look at some charts. You’ll notice how similarly the 10-year yield and mortgage rates move.

Here is the 10-year Treasury Yield:

Here are the average mortgage rates:

Mortgage rates climbed through mid-January even following the December rate cut.

The spike you see in April 2025? That came immediately after the announcement of the “Liberation Day” tariffs. The 10-year bond yield and mortgage rates both jumped in response.

So if the Fed has cut rates, why hasn’t the 10-year bond yield (and then mortgages) followed? A big reason is that confidence in the U.S. government has slipped—just slightly, but enough to matter. For decades, Treasury bonds were seen as absolutely safe. That perception is changing. All three major credit rating agencies have downgraded U.S. government debt from AAA to AA+. Investors are now demanding a higher return to account for even a small degree of fiscal uncertainty.

This increase in perceived risk has pushed up Treasury yields, which in turn drives up mortgage rates.

So no, if Jerome Powell cuts rates tomorrow, that won’t automatically restore faith in the federal government. And if Trump fires Powell and installs a “yes man” to slash rates, that won’t fix it either.

If we want lower mortgage rates, we need to restore investor trust in the U.S. government as a financially responsible institution. That means tackling the debt and deficit. But so far, neither party has shown serious interest in doing what’s necessary.

We need to cut spending and raise taxes. But no one wants to have that conversation. Until we do, magical thinking and campaign promises will continue to dominate policy, and we’ll keep paying for it in the form of higher borrowing costs.

Debrief on Deck

Next week, we are already recapping July. Please don’t be mad at me for saying this, but summer has turned the corner. The days are getting shorter. Back to school ads have started. The heat is still here, but winter is coming.

As always, please reach out to us with any questions or comments you have. You can reply directly to this email or find us on Instagram.

Until then, stay the course.

Wilson