- Dollar Debrief

- Posts

- What is fixed income?

What is fixed income?

Who will fix my income?

Classic AWS outage this week. Who knew that the company you rely on to get more tide pods the next day also runs the servers for your water-cooled mattress cover that tracks your sleep data as well?

What is fixed income?

Fixed income is any type of investment that pays you on a set schedule, usually in the form of interest. Unlike stocks, which can fluctuate wildly in value and returns, fixed income provides stability and predictability. Think of it as the “steady paycheck” side of your portfolio.

Why It Matters for Retirement

While it’s fun to watch your portfolio rise and fall in your 20s-30s, it gets more serious as you approach retirement. 25-40% swings in your net worth can have huge impacts on what you can afford in retirement. That’s where fixed income comes in. It provides consistent payments that help retirees cover living expenses without having to constantly sell investments. Fixed income is about reliability. It’s not there to make you rich. It’s there to make sure you don’t run out of money.

Many financial advisors recommend that as you get older, your portfolio should slowly shift from growth-oriented stocks to safer, fixed income securities. That’s because fixed income investments like bonds and annuities can act as a cushion against stock market volatility while still providing predictable (small) returns.

When you buy shares in a company, you could lose all your money tomorrow or triple it in a week. The odds of either outcome are unlikely, but they’re not 0. In other words, don’t buy 10 shares of Apple thinking “I’ll sell this next month to pay my rent.”

With fixed income, you know exactly how much money you’ll receive every month or quarter the moment you buy the fixed income. It’s going to be closer to 3-6%, but still, that is predictability you can plan on - albeit extremely boring.

What securities are considered Fixed Income?

Fixed income covers a broad range of investments, including:

Government bonds: These are loans to federal governments (not just US) that pay regular interest.

Corporate bonds: Loans to companies which usually pay higher yields compared to government bonds to compensate for higher risk.

Municipal bonds: Issued by states and local governments, often with tax advantages.

Certificates of deposit (CDs): Bank-issued products that pay fixed interest for locking up your money.

Annuities: Insurance products that provide guaranteed income for a set period—or for life.

Dividend-paying stocks are not fixed income. While dividends may feel predictable, companies can change or cancel them at any time. Stocks are equity and represent ownership, not a contractual obligation to pay you. Fixed income, on the other hand, is a debt instrument. You’re lending money and being promised a return.

Yet another Schwab Robo Advisor Ad…

I know I talk about Schwab’s Robo Advisors a lot… I really wish I could say they are paying me. Sadly, I do this for free.

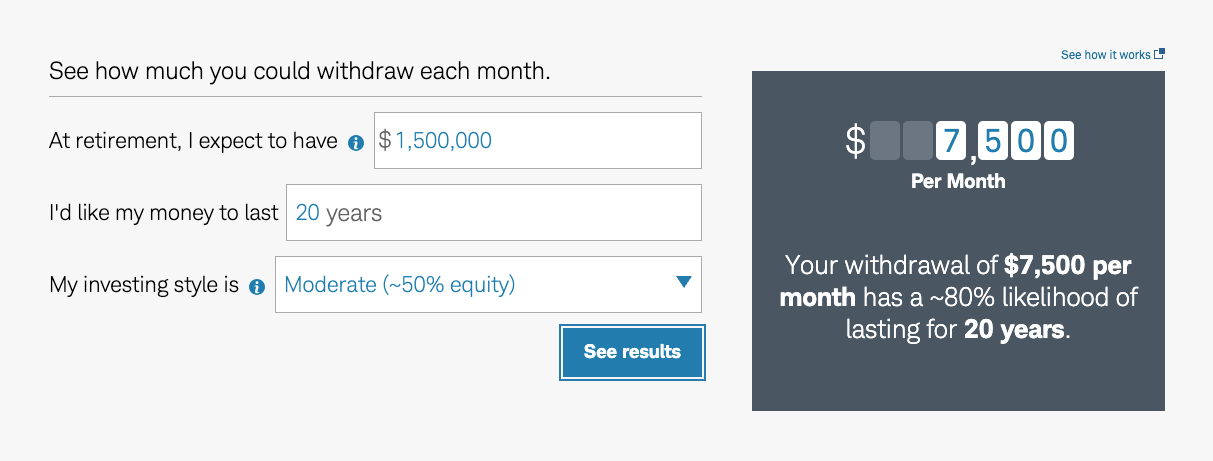

Schwab Intelligent Income is a feature in their intelligent portfolio suite of tools. It curates a portfolio mixed with stocks, fixed income, and cash to deposit a check into your checking account each month. You tell them how much money you have (or expect to have) and how long you want to live (morbid), and Schwab tells you how big of a check you’ll get each month.

I am not even close to retiring yet, but I promise I am already excited to use this feature.

Side note, Mike answered “how much money do I need to retire” in an earlier letter which talks about safe withdrawal rates, the principals behind the Schwab income portfolio.

The Size of the Fixed Income Market

When most people think of investing, they think of the stock market. But the bond market—the core of fixed income—is actually much larger. Globally, the bond market is estimated at around $140 trillion, compared to roughly $110 trillion for equities. In the U.S. alone, the fixed income market sits at about $51 trillion, beating the $46 trillion U.S. stock market.

That scale tells you something: fixed income isn’t boring—it’s foundational. It’s where governments fund infrastructure, corporations raise capital, and retirees find stability.

Final Thought

Fixed income may not be flashy, but it’s the quiet workhorse of retirement planning. It provides balance, predictability, and peace of mind. However, don’t flood the bond market the first time a hotel bed makes your back hurt because the mattress is too soft. The bond market is here now and will be tomorrow.

Debrief on Deck

Next week, in honor of halloween, we will talk about bankruptcy. It’s scary, and I hope the dollar debrief has helped you stay away from this thought.

As always, please reach out to us with any questions or comments you have by replying to this email.

Until then, stay the course.

Wilson